can you pay california state taxes in installments

The personal income tax rates in California range from 1 to a high of 123 percent. These are levied not only in the income of residents but also in the income earned by non-residents who.

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)

Form 9465 Installment Agreement Request Definition

Your remittance voucher is included in your instalment reminder package the CRA mails to you unless you pay instalments by pre-authorized debit.

. The requested tax instalment. Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. I have installments set up for my federal taxes but I did not see an option for California state taxes.

Under the agreement youll make. To avoid interest charges you must pay tax instalments totalling the lesser of a your tax owing for the year or b what CRA requested of you. Businesses typically have to repay what is due within.

Dont Let the IRS Intimidate You. In order to qualify you must. If you are unable to pay your state taxes you can apply for an installment.

Usually you can have from three to five years to pay off your taxes with a state installment agreement. Under a Guaranteed Installment Agreement there is no minimum monthly payment as long as you pledge to pay off your balance within three years. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement.

However this is one of the most difficult states in terms of registration. Free Competing Quotes From Tax Relief Consultants. Ad Dont Face the IRS Alone.

Installment payment agreement IPA If youre unable to pay your tax bills in full you may qualify for an installment payment agreement IPA. Get A Free Tax Relief Consultation To Eliminate Tax Debt. By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO.

It may take up to 60 days to process your request. Franchise Tax Board State of California Installment Agreement Request We will always ask you to immediately pay your tax liability including interest and penalties in full. Yes you can use the APs income tax payment plan to pay what you owe over time in government taxes.

If one of these events has happened and you are simply unable to pay immediately you may be wondering Can I pay taxes in installments Yes it is possible to pay taxes in. If you are unable to pay your state taxes you can apply for an installment agreement. As an individual youll have to pay a 34 setup fee which will be added to your balance when you set up a payment plan.

Second Installment Payments For 2019 20 Secured Property Tax Bills Are Due February 1st County Of San Luis Obispo

Sample Commercial Rental Agreement Rental Agreement Templates Room Rental Agreement Commercial

Irs Tax Letters Explained Landmark Tax Group

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Installment Agreement Request California Franchise Tax Board

The Easy Guide To Making Estimated Tax Payments Nest Payroll

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Property Tax Prorations Case Escrow

Supplemental Secured Property Tax Bill Placer County Ca

Lease And Buy Agreement Real Estate Forms Real Estate Business Template

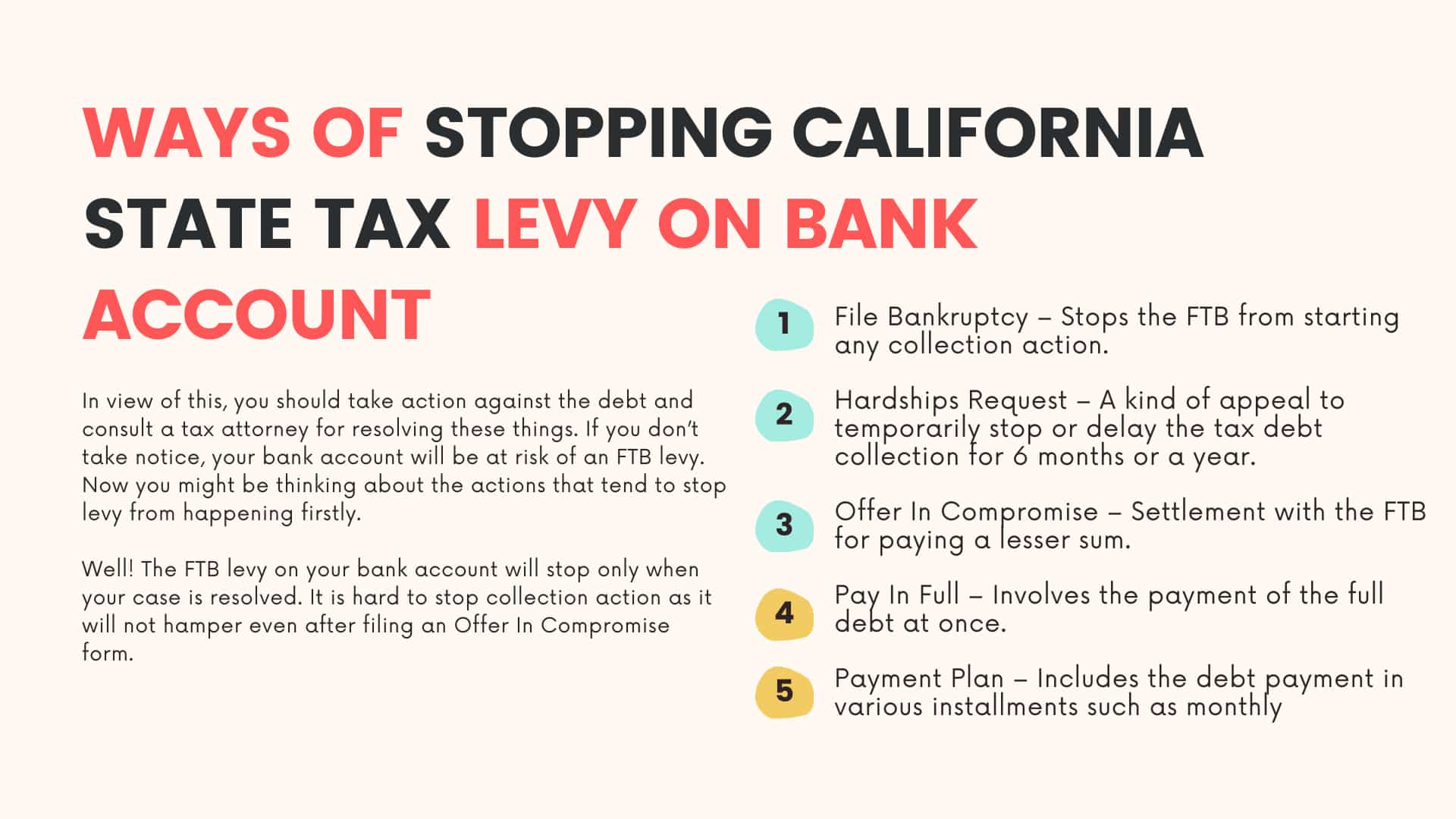

3 Proven Ways To Stop California State Tax Levy On Bank Account

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at11.00.22AM-1f51d54182cb40b0b110e0940688fbb8.png)

Form 6252 Installment Sale Income Definition

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Can I Pay Taxes In Installments

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

San Jose 1886 Old Map Reprint Advertising On Edges Etsy Old Map Old Maps California City

How A 390 459 Irs Debt Reached A 94 Settlement Landmark Tax Group